Lease net present value calculator

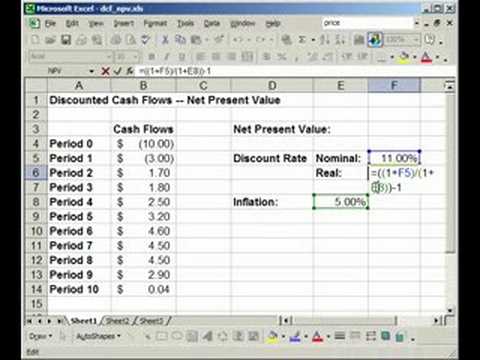

If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula. The figures of NPV for.

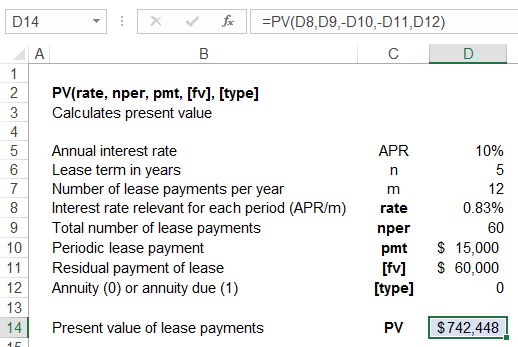

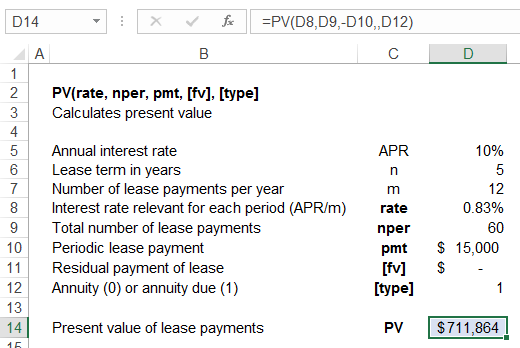

How To Calculate The Present Value Of Lease Payments In Excel

It is most commonly associated with car leasing.

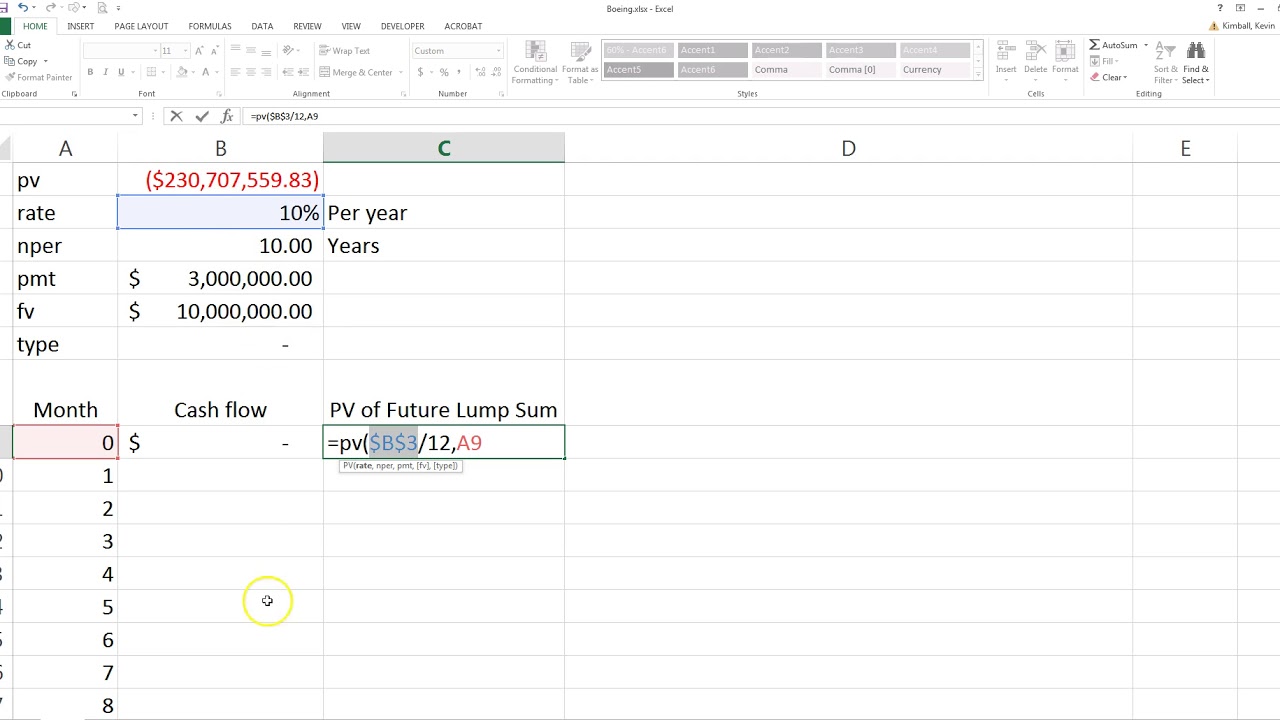

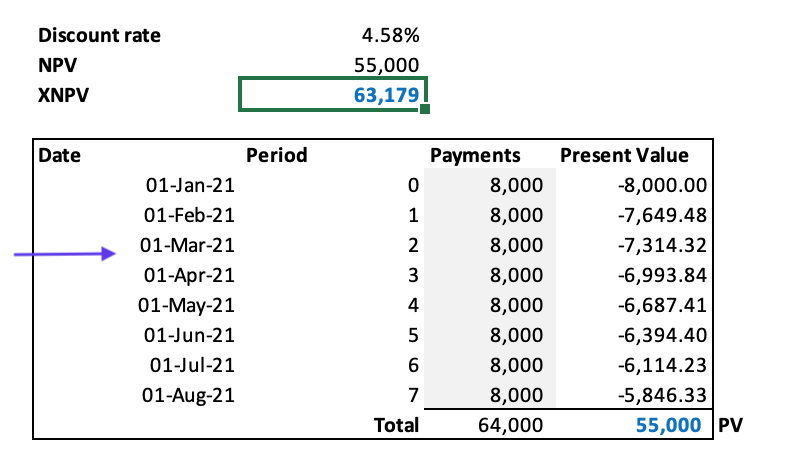

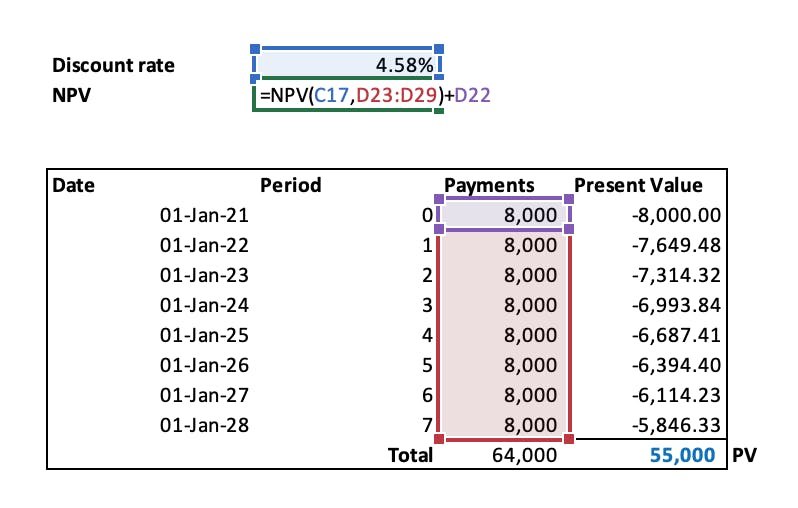

. Capitalize your leases based on. All of this is shown below in the present value formula. In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time.

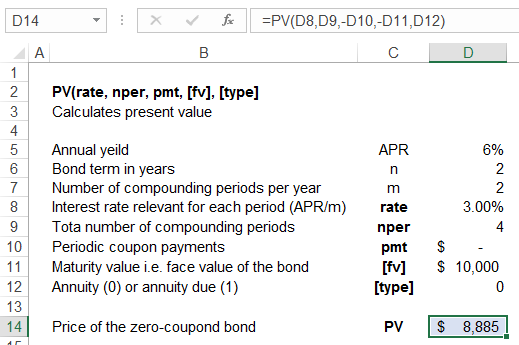

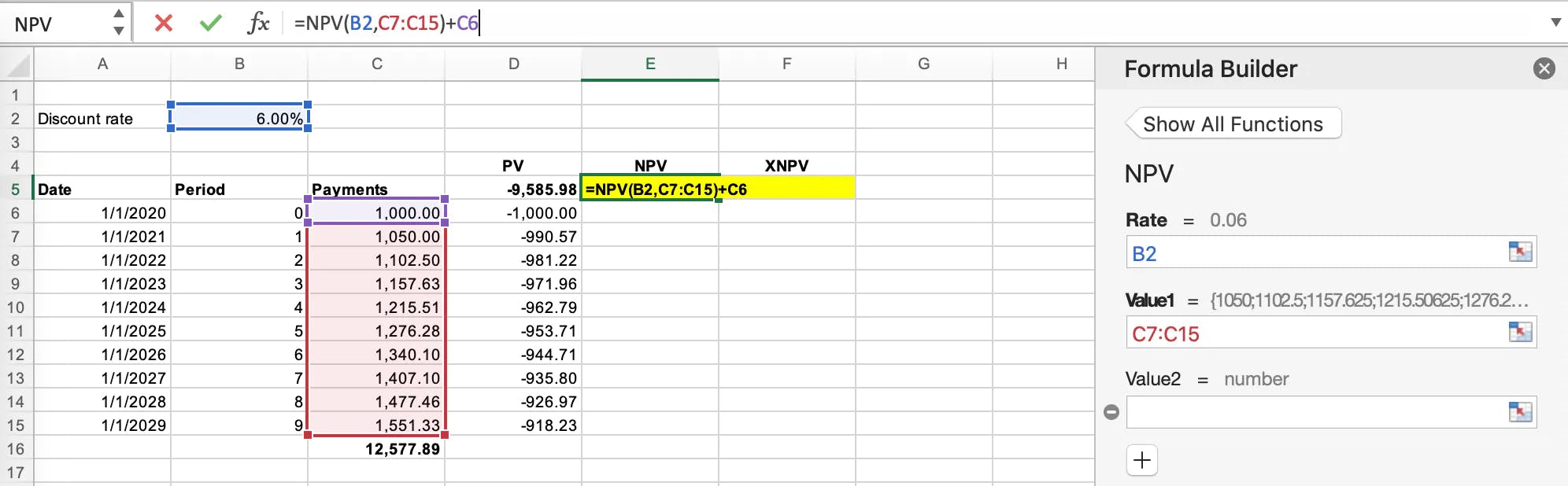

While the former is. 1 The NPV function in Excel is simply NPV and the full formula. FV This is the.

PV Present Value CF Future Cash Flow r Discount Rate t Number of Years Inputs In order to calculate the present value of lease payments judgements will need to be. In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow. Pay SDLT on 55000 at 1.

PV FV 1r n PV Present value also known as present discounted value is the value on a given date of a payment. Present Value Calculation Tool GET THE TOOL Download our Present Value Calculator to determine the present value of your lease payments under ASC 842 IFRS 16 and GASB 87. The tax calculator allows taxpayers and agents to work out the amount of LBTT payable on residential non-residential or mixed property transactions and non-residential lease.

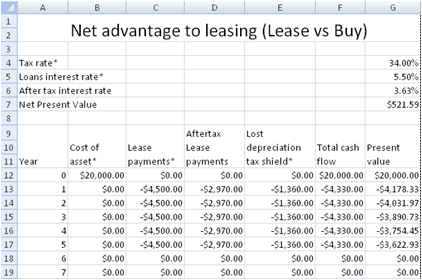

Residual value sometimes called salvage value is an estimate of how much an asset will be worth at the end of its lease. Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Net Present Value - NPV.

It is important to make the distinction between PV and NPV. Formula and Steps to Calculate Net Present Value NPV of Lease Accounting and Analysis NPV Net Cash In Flowt1 1rt1 Net Cash In Flowt2 1rt2. Calculate the present value of lease payments for a 10-year lease with annual payments of 1000 with 5 escalations annually paid in advance.

This calculator is a tool to use to compare different possible lease scenarios and rates. NPV Todays value of expected future cash flows Todays value of invested cash An NPV of greater than 0 indicates that a project has the potential to generate net. A popular concept in finance is the idea of net present value more commonly known as NPV.

Net Cash In Flowtn 1rtn. Where r is the discount rate and t is the number of. The Lease Net Present Value calculator totals all the present values of a lease to a single sum.

In this example if you purchase the residential lease in the period between 8 July 2020 to 30. Calculate the NPV of the rent payable for each year of the lease term using either the calculator provided on the GovUK website or the formula at FA03SCH5PARA3. Add this to the amount of SDLT due on the premium.

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments In Excel

Calculating Present Value In Excel Function Examples

Compute The Present Value Of Minimum Future Lease Payments Youtube

Calculating Present Value In Excel Function Examples

Calculate Lease Payments Tvmcalcs Com

Free Lease Or Buy Calculator Net Advantage To Leasing

Npv Calculator Irr And Net Present Value Calculator For Excel

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Calculating Present Value In Excel Function Examples

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Discount Rate Implicit In The Lease

How To Calculate The Discount Rate Implicit In The Lease

Get The Net Present Value Of A Project Calculation Finance In Excel Npv Youtube

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Future Lease Payments